How to Make the Most of the Paycheck From Your Summer Job

Summer jobs are a rite of passage. Whether you're spending your summer flipping burgers, wrangling kids at camp, or manning a lifeguard station, one thing is certain: regular paychecks can make it all worthwhile. You want to make sure you’re saving enough money now so that you don't run out of cash during the school year. Even if you keep your job during the school year, you’ll have an extra cushion by saving as much as you can now.

When it comes to stretching your saving, there's no need to stress over your money management skills. Below are tips on how to plan, save, budget, and spend wisely. Learn these lessons now, and you'll have personal finance skills that will benefit you for a lifetime.

1. Set a goal

How much should you save from paychecks? That depends on your current and future expenses and how much you can afford to designate to savings. Come up with a percentage that works for you and calculate how much you can save over the summer.

For instance, if you anticipate earning $3,000 over the summer and commit to saving 50 percent of every paycheck, you'll save $1,500 over a three-month period, that’s $166 to spend each month over the nine-month school year. Commit to saving 70 percent every payday, and you'll save $2,100 to cover food, entertainment, school activities, and gas expenses ($233 to spend each month) through the fall, winter, and spring.

2. Aim for a higher hourly rate (tips count!)

It might seem like a no brainer, but as you’re looking for summer employment look for the highest paying job you can. The difference between $10 an hour and $11 an hour can have a big impact. Here’s a breakdown before taxes and assuming you work 30 hours a week.

- $10 an hour x 30 hours = $300 a week x 4 weeks = $1,200 a month x 3 months = $3,600

- $11 an hour x 30 hours = $333 a week x 4 weeks = $1,320 a month x 3 months = $3,960

Those couple extra dollars might seem like no big deal, but your future self will appreciate the time and energy you put into saving as much money as possible.

3. Spend responsibly: Create a budget and spending plan

Once you've saved a tidy sum of money, you'll want to spend it responsibly. Allocating your money in a monthly budget may seem intimidating, but there are a variety of ways to make it easier. Research ways to budget to find one that works for you. Consider downloading a budgeting app (or your bank’s online banking may have one already built in), but always check multiple online reviews. Also, look for (and use) cyber-security safeguards such as multi-factor authentication.

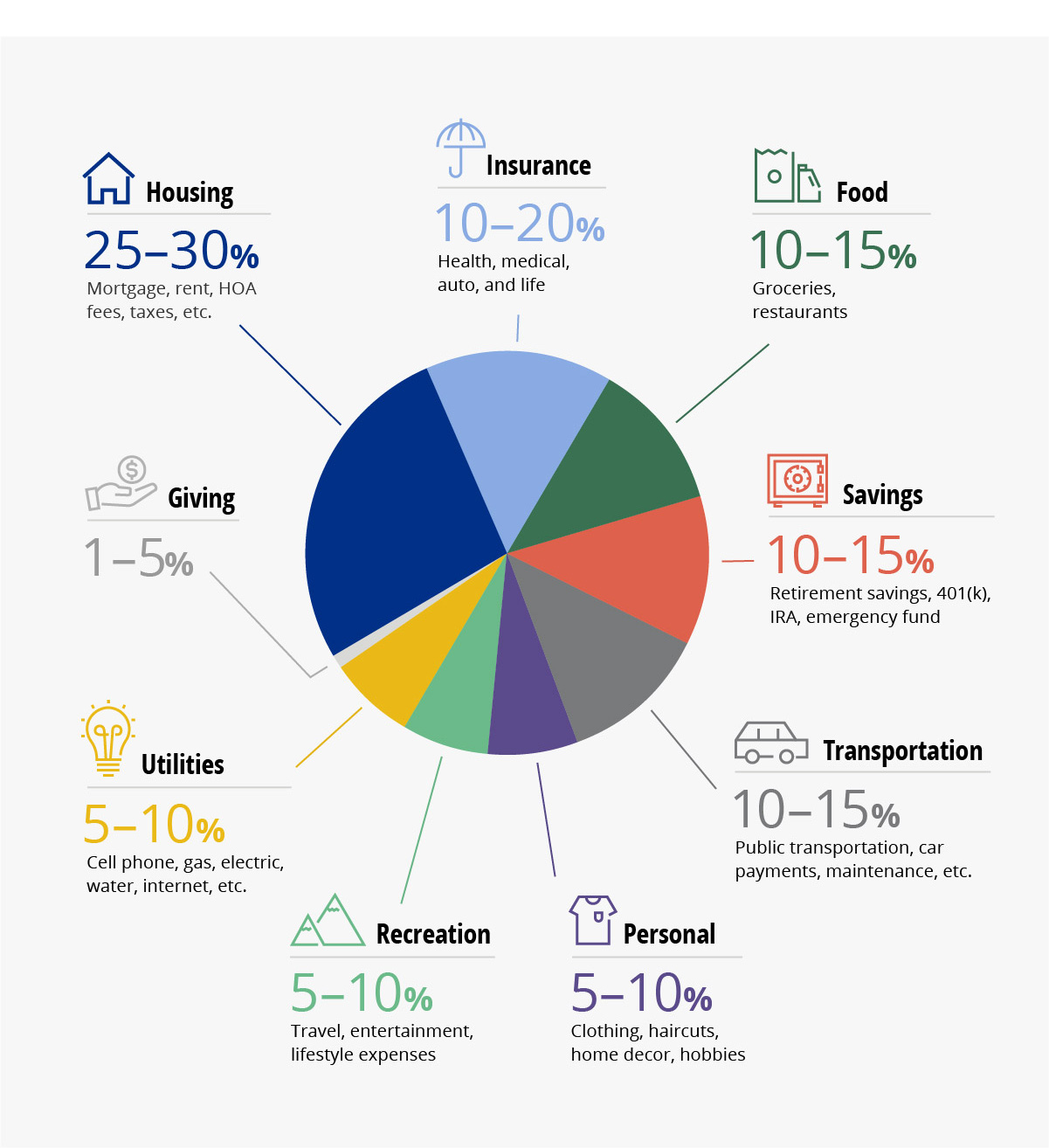

Start by spending some time thinking about your expenses through the year. Decide which expenses are non-negotiable and which ones are merely nice-to-haves. Gas or cell phone payments, for example, might be expenses that can't be cut from your budget. Maybe you have a goal to buy new sports equipment or attend a concert next spring; set money aside for those priorities.

By planning ahead, you can make money-saving adjustments for impulse buys like clothes, eating out, and entertainment. You don't have to deny yourself of everything you love, but a little give-and-take with non-essential expenses can go a long way with preserving your savings. Try these other methods to maximize your money throughout the year:

- Try the envelope system: If you allocate weekly cash amounts to designated envelopes for things like gas, food and entertainment and stop spending on those things when the cash runs out, it may be easier to stay on budget than if you pay for everything with a credit or debit card.

- Set up automatic transfers: One way to avoid draining savings prematurely is to set up a recurring auto-transfer from your savings to your checking account. If you arrange an automatic monthly transfer from your bank savings account to your checking account over the next nine months, you'll have a consistent "paycheck" to work with. Be aware that you don't get unlimited transfers from savings to checking; keep it to six or fewer transfers each month.

The Bottom line

It’s easy to live in the moment and use your summer paycheck to pay for fun things. But by planning ahead and sticking to a budget, your paycheck can actually tide you over for an entire school year. It’s a great habit to start as you attend collage or get a full-time job. To begin, sign up for online and mobile banking to monitor your bank accounts and transfer funds to savings.