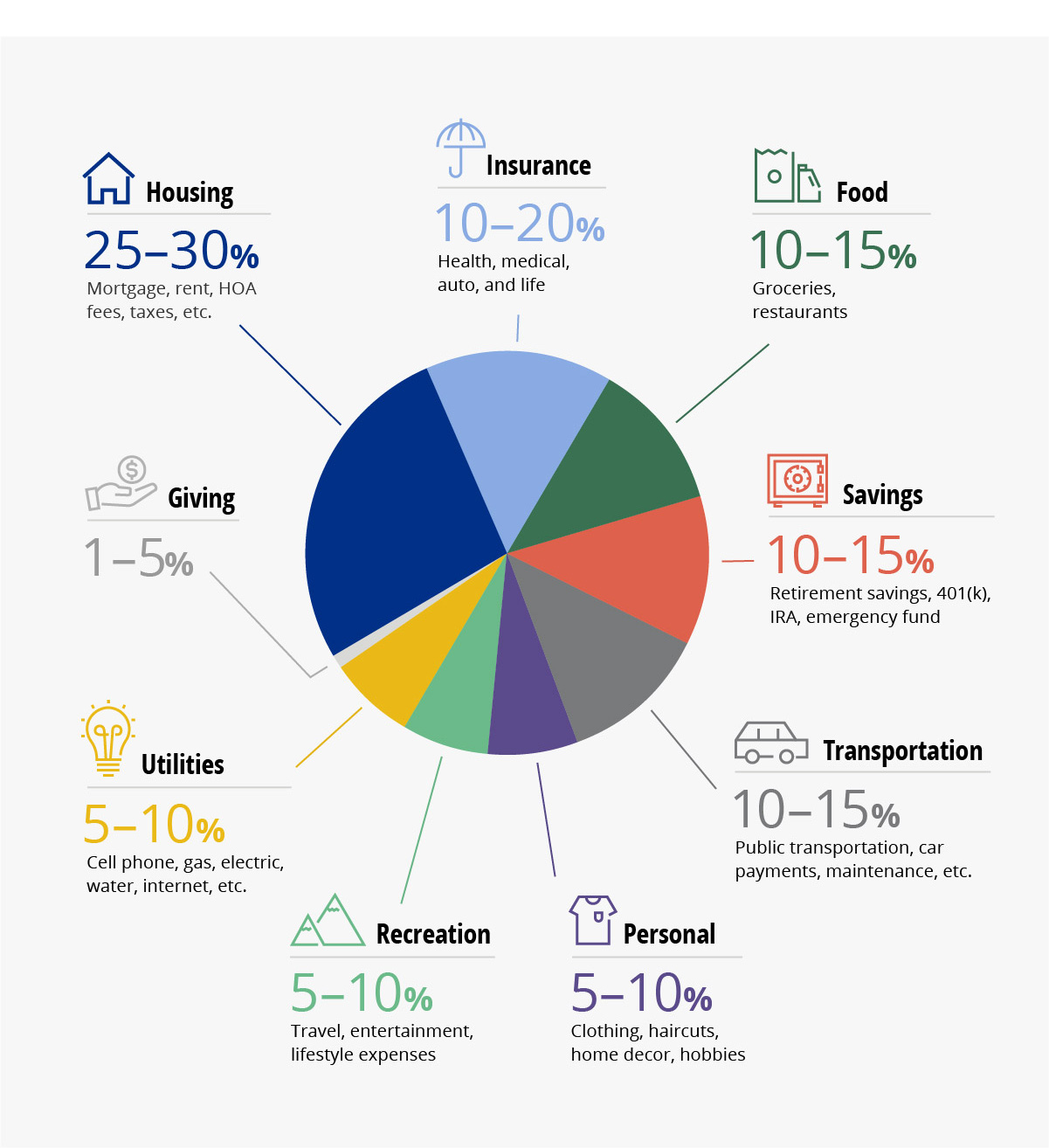

The Best Way to Slice Your Budget

Creating a budget is the first step to financial stability, but creating a budget isn't only about tracking your expenses. It's also understanding your larger financial picture so that you can adjust your plan to make sure you're meeting your financial goals. Using percentages allows you to create a budget that flexes with your income and prioritizes your spending. When you divide your budget into categories, you begin to understand what could be eating up too much of your budget and what you could change.

Depending on your circumstances, you may need to add categories (debt repayment, childcare, health care costs, etc.) or adjust others. It may take some time to find the right balance, but no matter how you slice it, a percentage-based spending plan can help you stay on track toward financial wellness.

This infographic shows the following budget percentages, 10-20% for Insurance, 10-15% for Food, 10-15% for Savings, 10-15% for Transportation, 5-10% for Personal, 5-10% for Recreation, 5-10% for Utilities, 1-5% for Giving, 25-30% for Housing.