3 steps to save your first $1,000

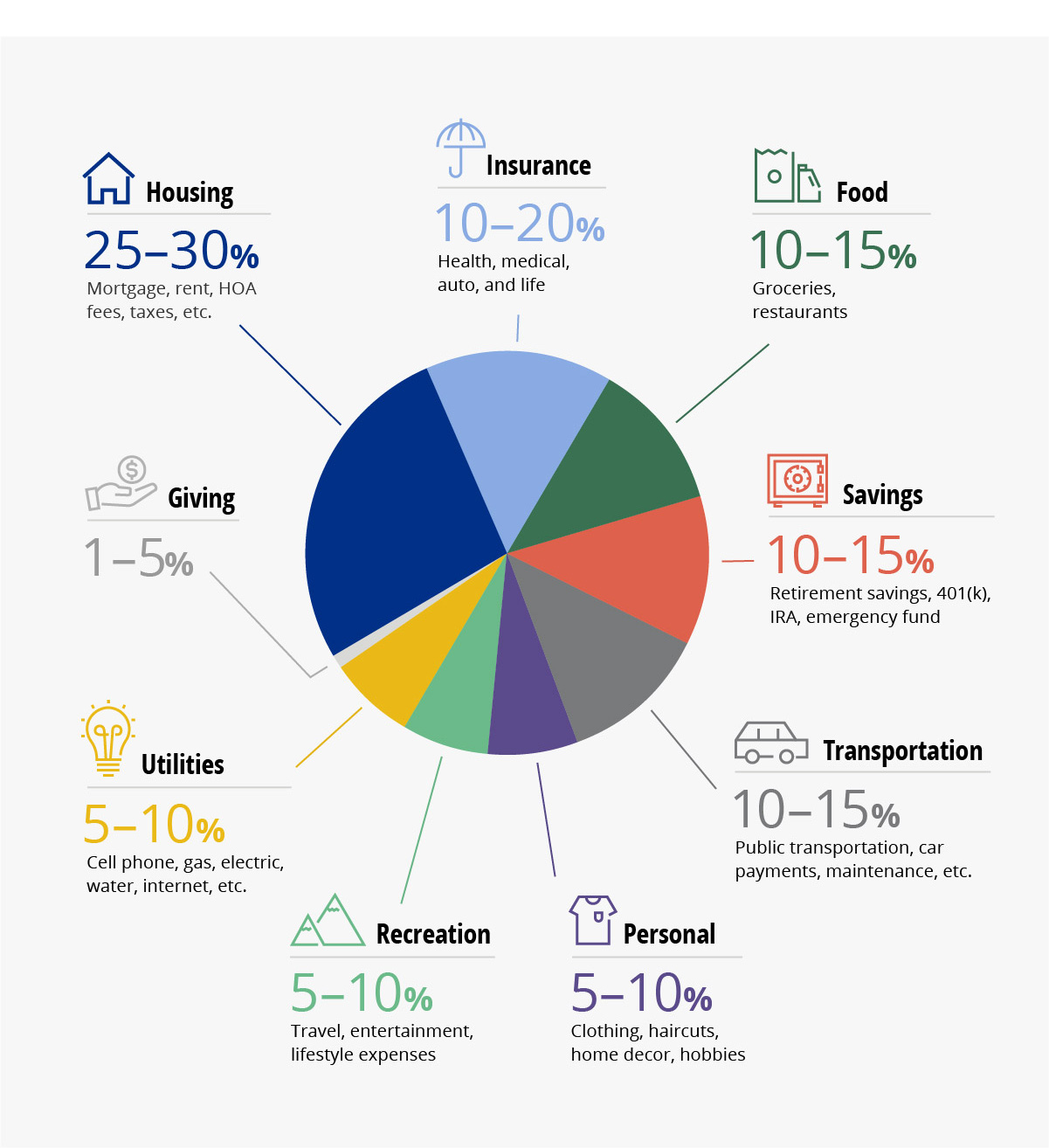

Whether saving for a vacation, a new home, or simply some financial peace of mind, saving your first $1,000 is a good milestone to kick start your savings goals. Schedule some time to take a close look at your cash flow (what comes in and what goes out) and create a budget that works for your situation—one that you can realistically stick to. Then, amp up your savings with the tips below.

3 Steps to Save Your First $1,000

Saving your first $1,000 gives you a cushion for emergencies. It can also help you build good saving habits that lay the groundwork for a solid future as well as a dedicated emergency fund (experts suggest saving at least three months' worth of expenses). Learn how to get started and earn some financial peace of mind.

1. Learn and practice a new concept: “Bank it."

Whether happening upon a BOGO deal or finding a steal on Craigslist, you likely find many ways to save money. Time to employ the “bank it" concept. Rather than mentally high-fiving yourself and moving on when you snag a deal, put away the money you saved. Let's say that when you check out at the grocery store, there's a spot at the bottom of your receipt that says, “You saved $12.24." That's great! Now actually save it. Transfer that exact amount from your checking account into a savings account—“Bank it." Did you wait for a Memorial Day Sale to buy the new grill you've had your eye on? Nice work—bank what you saved. Get in the habit of saving your savings whenever you find them. You may be pleasantly surprised by how quickly these small amounts add up.

2. Set up automatic transfers.

Does your budget have some wiggle room—a little more cash coming in than going out? If yes, you have the ideal situation to set up automatic transfers into your savings account. You can often do this through your employer, sending specific amounts of money to separate accounts right from your paycheck. Or you can schedule automatic transfers with your bank that follow each payday. When you do this, you prioritize and automate your savings plan. You won't have to remember or even think about it—and you won't be tempted to skip a month. Instead, you can watch your savings balance steadily grow. Even $10 a month will add up over time.

3. Cut the fluff.

Take another look at your budget, especially if you feel like you're living paycheck to paycheck. Which expenses aren't completely necessary? Look for at least one spending habit that you can give up for a month or so and bank what you save. This way, you don't have to give up weekly trips to the movie theater or your coffee habit forever, but you'll know you can save extra money when needed by cutting back for a bit.

Next, are there any ongoing expenses that you can cut—ones that drain your available funds every month? We're talking subscription services that no longer spark joy or extra streaming channels you barely use. Cut back your total recurring expenses by canceling what you can or looking for more affordable alternatives. And if you get an offer that you can't refuse to keep something, that's okay. Just make sure to bank the extra. Let's say you spend $55 a month on your gym membership. But when you ask to cancel it, they offer a discounted rate of $25 per month. If you take them up on the offer, bank the difference—add this extra $30 that you've saved to the amount you auto-transfer to your savings.

When you get into the habit of banking what you save, it may even start to feel like a game. How much can you add to your auto-transferred amount? Can you beat your monthly record of one-time saving transfers? Keep track of what you save to make it more fun and watch that account balance grow.