What type of investor are you? Learn how to determine your investing risk tolerance

Most people have a natural aversion to risk. No one likes to experience losses, even if they're relatively small or likely to prove temporary. But without risk, there's often little or no possibility of reward.

Investment risk tolerance is a measure of how much loss you're willing to accept in your investment portfolio as you try to achieve your investment goals. The more risk you're willing to tolerate, the more investment opportunities you can consider. Higher-risk investments generally offer the possibility of higher returns.

Understanding risk tolerance and risk capacity

Risk tolerance isn't the same thing as risk capacity.

• Tolerance refers to how much risk you can stand, emotionally. If there's a market correction, will you panic and liquidate your investments, or will you wait to see whether the market recovers? If you'll panic, your tolerance for risk is low. If you're patient, your tolerance is high.

• Capacity refers to how much risk you can manage, financially. Are your funds limited or flush? Is your timeframe for your investment short or long? If you don't have much money to invest or you'll need the funds soon, your capacity is smaller than if you have more to invest or won't need the funds for a long time.

One way to understand the difference is to think about a campfire. The size of the campfire you can build with the amount of wood you have available is your capacity. How close you can stand to your campfire before it's too hot for you is your tolerance.

Risk tolerance and risk capacity are both important to establish an overall level of investment risk that's appropriate for you.

Factors that determine your investment risk tolerance and capacity

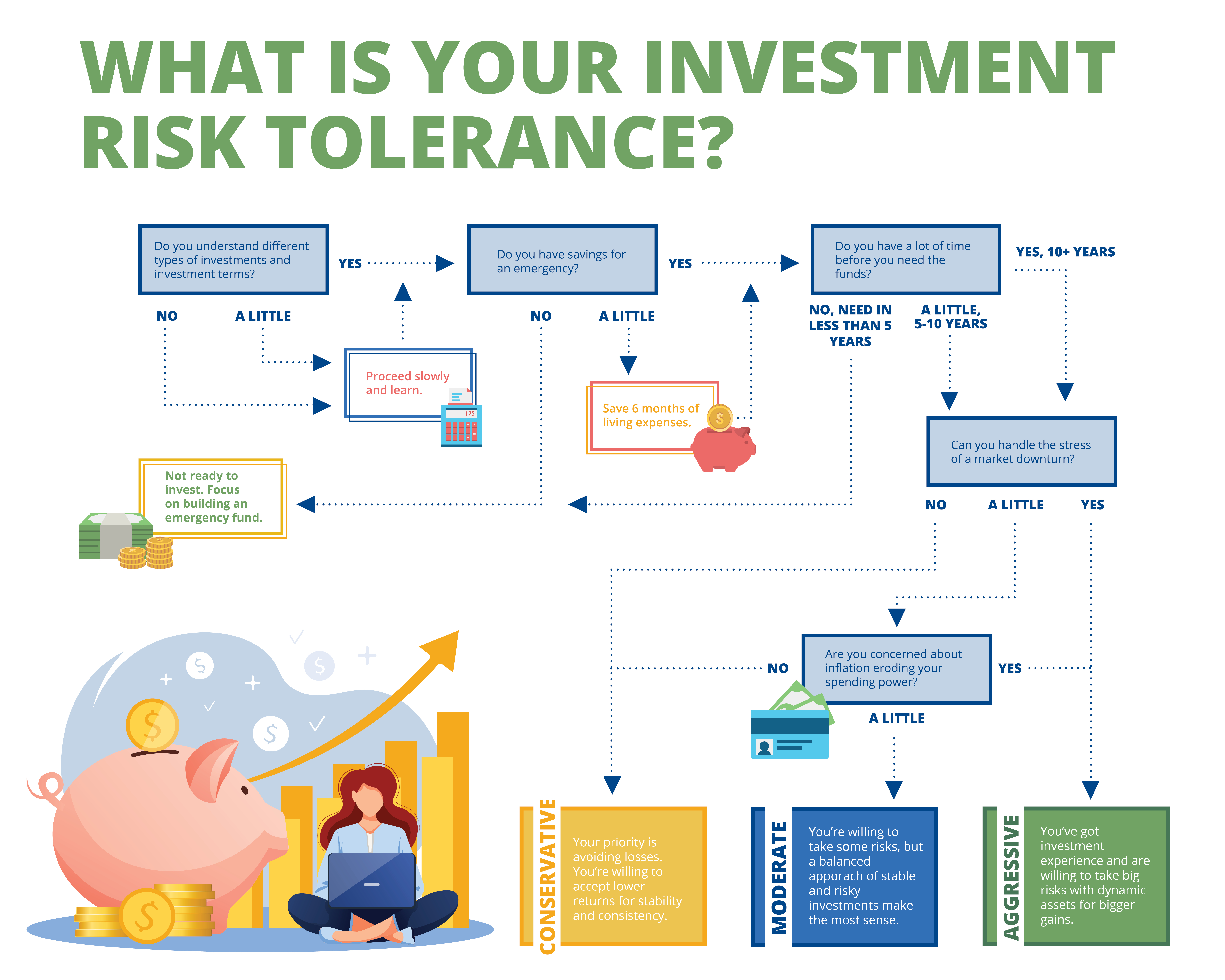

To figure out your investment risk tolerance and capacity, you'll need to ask yourself (and your spouse or partner, if you're investing together) some important questions:

1. Do I understand different types of investments and investment terms?

The more knowledgeable you are, the more comfortable you may feel. If your knowledge is limited, you may want to proceed slowly as you become better educated. Your financial advisor can help you learn more.

2. Do I have enough savings for an emergency?

Three months of living expenses may be a good target for your emergency savings unless you're self-employed, your skills are not in demand in today's job market, or your fixed expenses are high relative to your income. In those situations, you may want to aim for more than three months. With the right amount for you stashed away, your capacity to invest may be higher. If your savings are skimpy, you may not be ready to invest as much.

3. When will I need the funds I plan to invest for other purposes?

A short time horizon means you don't have a lot of room to weather a market downturn and make up any losses you may experience. Consequently, your capacity to invest may be limited. With a longer time horizon, you may be well-positioned to invest more.

4. Am I concerned about inflation eroding the purchasing power of my savings?

Low-risk investments may not earn large enough returns over time to overcome the effects of inflation. For example, a conservative investment portfolio may not position you to pay future medical costs. If that worries you, you may be more motivated to accept more investment risk.

5. Will I feel severely distressed if there's a market downturn and my investments sustain significant losses?

Historically, the U.S. stock market has experienced a repeated cycle of ups and downs. These trends are predictable in the sense that the markets generally tend to be cyclical, yet the timing of a downturn is never certain. Committed long-term investors can expect to experience one or more significant downturns over their investment time horizon.

The more concerned you believe you'd feel about a major market correction, the less comfortable you may be with a higher level of investment risk.

These questions don't have right or wrong answers that are the same for everyone. The right answers for you depend on your financial situation and your feelings about investment risk.

Why your investment risk tolerance is important

Your investment risk tolerance affects the types of investments that may (or may not) be appropriate for you.

If your tolerance is high, you may want to consider riskier investments, such as growth stocks and high-yield bonds. If your tolerance is low, you may prefer to stay with conservative choices, such as Treasury bonds. With a moderate risk tolerance, a balanced strategy may make sense.

If your risk tolerance is too low to achieve your goals, you may need to take more risk than you'd prefer. For example, if you're close to retirement but you haven't saved much, you may need to consider riskier investments to try to "catch up."

A better approach is to start investing earlier and divide your investment funds into different "buckets" with different strategies. Your down payment for a home you intend to buy within a few years might be invested more conservatively, while funds in your retirement account that you don't expect to need for decades might be invested more aggressively.

When should you revisit your investment risk tolerance?

Your investment risk capacity and tolerance aren't static conditions that you can set and forget. Rather, your capacity and tolerance can—and probably will—change over time.

You should revisit both issues whenever you experience a big change in your life, such as getting married, starting a new job, buying a home, adding a child or aging parent to your household, or retiring from your career.

If nothing changes, you should still revisit your capacity and tolerance at least once each year. If you're an active investor, more frequent reassessments may be appropriate for you. Your financial advisor can help you make your initial assessment and set up a schedule to revisit these important aspects of your investment strategy.