How to calculate your home equity

What is Home Equity?

The equity in your home is the difference between the current appraised value of your home and the amount you still owe on your mortgage. The equity in your home can be your most powerful tool to help you pay for things, from home renovations to a college degree.

Calculating your home equity is simple. Take your home's value, and then subtract all amounts that are owed on the property. The difference is the amount of equity you have. Here’s an example:

Your home's market value can change depending on the economy and a variety of other factors. Before paying for a full appraisal, to get a ball-park estimate, you can find home value estimates online from sites like Zillow, Redfin, or Trulia1. Keep in mind that these sites are just estimates and could be different from a home appraisal that a bank would use for your loan.

What is LTV and how can it affect how much I borrow?

Loan-to-value (LTV) ratio determines how much a lender is willing to lend when using your home as collateral.

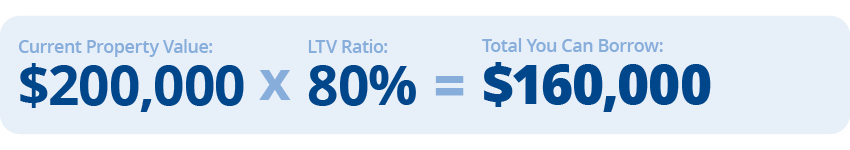

Many financial institutions use a LTV of 80%, which means they won't borrow more than 80% of your home's value. The overall debt includes your mortgage and any new loan or line of credit you receive. Using the same example above, here’s how LTV would affect your borrowing power.

If you’re paying private mortgage insurance (PMI), it’s a good idea to keep track of your LTV ratio. The Homeowners Protection Act requires lenders to automatically cancel PMI when a home’s LTV ratio is 78% or lower (provided certain requirements are met).

Once you've calculated your available equity, you can decide if it’s feasible to use your home as collateral for a home equity line of credit.

You’ve invested in your home, now put the value of your home to work for you.